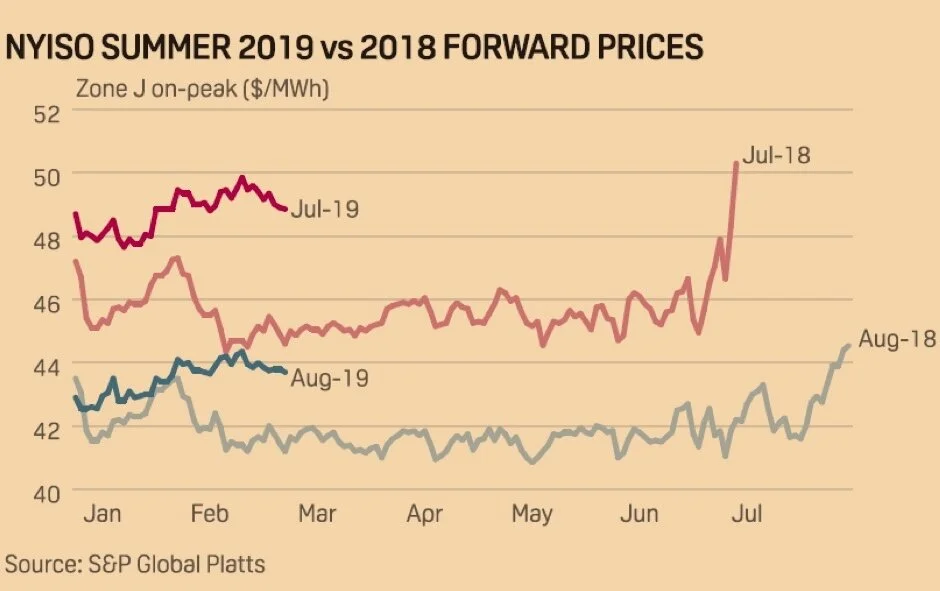

Like the well-known rock group WAR said “Cause it’s Summer, my time of year”. And with electricity generators all around the US. Summer is the time when capacity values can actually rise above fuel costs and provide some beneficial incremental margin to owners of efficient generation. This translates to higher hourly price volatility for customers. The above chart was published in April 2, 2019 in Megawatt Daily in a report about NYISO’s prediction of its system wide peak demand. What this graph shows us is a year over year increase in July prices of $4 and August prices of $2 for New York City. MW Daily points out that generation prices are higher year over year for the Summer. In looking at fuel prices for this load, gas is only up about $.10 per MMBtu which implies that the system is valuing the ability to produce power at a higher rate than a year ago. There is support for this notion as last Summer prices in New York City cleared on the spot market very near to the forward prices. (LBMP for July was $46 and for August was almost $50.) This is unusual as LBMPs usually clear at a discount to forward prices.

Does all this mean the consumer should hedge for July and August? It does. Taking risk off the table during volatile periods is simply good risk management practice.

But this graph is really telling in that it shows a significant run-up as we get closer to the prompt month. It is far better not to wait to buy Summer power until the end of June. In fact, a customer would have done extremely well to get this power hedged in April or May to avoid any potential upward revisions in the weather forecast. Nothing good for consumers happens in June for the forward July or August markets. Bottom line – if you are going to hedge – do it early.

Ke Wang

Senior Energy Analyst